Women Seem to be Most Impacted By Coronavirus Layoffs

Latest

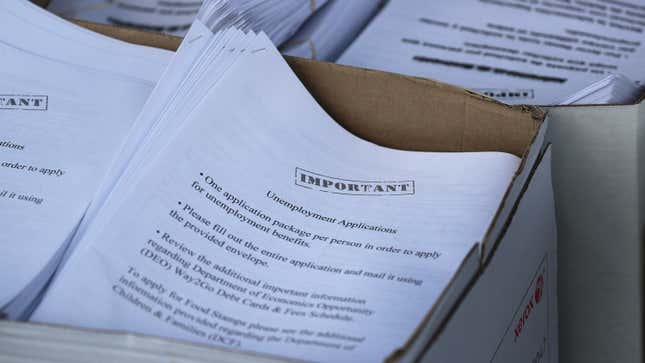

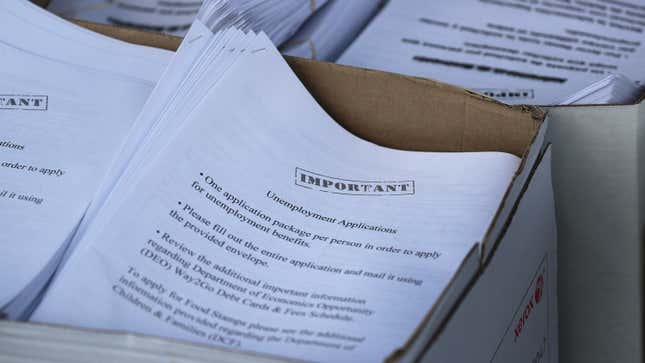

In the last two weeks of March, a staggering 8.7 million Americans filed new unemployment claims as non-essential businesses shut down due to stay-at-home orders. And the industries hardest hit, like restaurants, retail stores, and hospitality businesses, are frequently staffed by majority women workers, according to statistics analyzed by Fuller Project for International Reporting.

According to the report, women in Minnesota, New Jersey, and Virginia comprised nearly two-thirds of unemployment applicants. These figures are 21 to 39 percent higher than average. In New York state, more than half of new unemployment applicants were women. These numbers are unprecedented; in the last 25 years women have never broken above 40 percent of the unemployed.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-