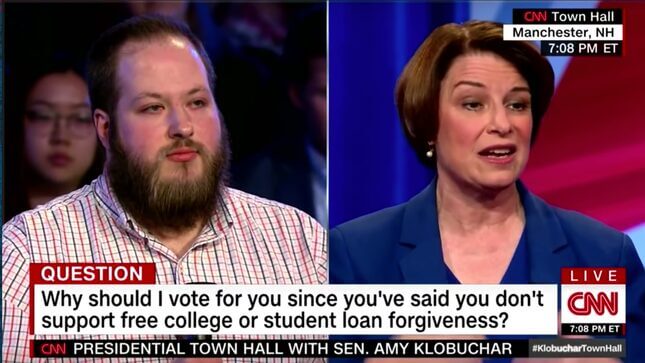

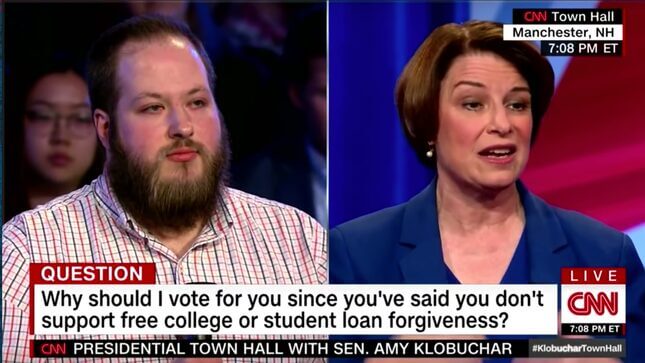

During a Monday night town hall on CNN, a college student in the audience asked Senator Amy Klobuchar why he should vote for her when she hasn’t backed student loan forgiveness like some of the other candidates in the field—notably Elizabeth Warren, who on Monday announced a proposal to erase $50,000 in student loan debt for every person with a household income below $100,000. Klobuchar’s response was, in a word, uninspiring.

“The first thing I would do is allow students, no matter how old they are, to refinance their student loans,” Klobuchar said. Her other plans: Expand Pell Grants, and free community college. “I wish I could staple a free college diploma under every one of your chairs,” she added, voice somber. “I wish I could do that, but I have to be straight with you and tell you the truth.”

Klobuchar isn’t alone in dismissing debt-forgiveness proposals as misguided fantasy. Fox News called it an “Oprah-like freebie contest.” The National Review covered it under the headlines: “Elizabeth Warren Wants to Pay Off Your Student Loans with Other People’s Money” and “Elizabeth Warren’s College Plan Is a Dance with Elves.” Anecdotally, there was also a response from older voters who seemed angry at the idea of debt cancellation. Whatever the ideological pretext, the critiques make similar arguments: the plan is an expensive cop-out, a get out of jail free card for those stupid enough to fall into debt and those who aren’t industrious enough to crawl out of it.

To the question of expense, Warren has already outlined a plan to pay for it (though many of these conservative critics never ask how we will pay for, say, massive tax cuts for the wealthy or endless war): “The entire cost of my broad debt cancellation plan and universal free college is more than covered by my Ultra-Millionaire Tax — a 2% annual tax on the 75,000 families with $50 million or more in wealth,” Warren explained in a Medium post.

That small change in the tax code could be transformative for millions of people. There is more than $1.4 trillion of student loan debt in the United States, shared among more than 44 million borrowers. Some critics have gone so far as to call the student-loan industry a “failed social experiment” given its disastrous results.

A study from the Federal Reserve Board found that for millennials, “the average student loan balance for millennials in 2017 was more than double the average loan balance for Generation X members in 2004.” On top of that, despite being the most educated generation, millennials are, “less well off than members of earlier generations when they were young, with lower earnings, fewer assets, and less wealth.” Warren’s plan is aimed at addressing, or beginning to address, the structural, systemic, and generational consequences of such debt. It’s not a “giveaway.”

And to that point—the idea that it’s wrong to forgive debt, or rewarding people for acting irresponsibly—there may be something useful to look at in Warren’s own transformation on the issue: Warren was a Republican until the ‘90s, and credits her political conversion to her own academic research on families struggling through bankruptcy courts. Seeing their plight convinced her that one’s financial peril isn’t measured by how hard they work.

Through her research, it became clear that without stronger safety nets, something like a job loss, unexpected medical expense, or other life change was enough to plunge even the hardest working Americans into insurmountable debt. She saw that debt wasn’t a personal failure, it was a systemic one. That’s why the solutions need to be system-wide—and why individuals shouldn’t be left shouldering that burden alone. She’s making the same case today, whether or not her colleagues in the Democratic field are willing to hear it.